DZ's $ATER Analysis — Oct. 27, 2022

A large falling wedge forming since April 19, 2022 is soon reaching its conclusion… breakout soon?

Greetings fellow Aterians,

I am not a financial adviser, and nothing I share or say here should be taken as financial advice. You assume your own risks when buying/selling any stock. Do your own due diligence before making an investment decision.

1. DZ’s on Substack! but why?

Over the past several months, I’ve come to a couple of big revelations:

I really enjoy studying the markets, and in particular the state of the global economy.

Trading on a day-to-day basis is very time-consuming, and began eating too much of my time from both work and personal commitments.

I need an alternative means by which I can make passive income that justifies the amount of time I spend creating highly detailed analysis that I ultimately share with as many folk I know.

So I am giving this Substack a try, as a motivational means to share my analyses with everyone while making a small amount of money on the side. Trading for me has become far too distracting, especially given that it takes place during my normal work hours, and the reward that comes from trading no longer justifies the amount of time nor stress it entails. I would much rather spend this time continuing to stare at charts, offer unbiased and fair takes on what I think a particular stock (or ETF, etc.) is doing.

Ultimately, my mission has always been (as a fellow retail trader) to help the retail trader learn about the market, and to share the knowledge I have with the hope that it teaches them something valuable. I want retail to win, and while I am not a financial adviser & cannot offer financial advice, I believe my knowledge and my charts can help educate folks about the market and — if nothing else — deliver them information that helps them see the “bigger picture”. In this spirit, this is why I’m starting up a Substack — I can help retail by delivering good, factual data and charts for the purposes of education, and retail can help me in the form of a once-monthly venti Pumpkin Spice Latte. I also realize not all retail can afford another subscription, and for this reason, much of what I share here will be made available to The Retail Collective Discord and appropriate Reddit pages for free.

I’m not a professional financial adviser, after all, but for those that find my work valuable and for those who also appreciate the work and effort I do… this is your chance to help me. I thank each and every one of you for considering putting forth this effort.

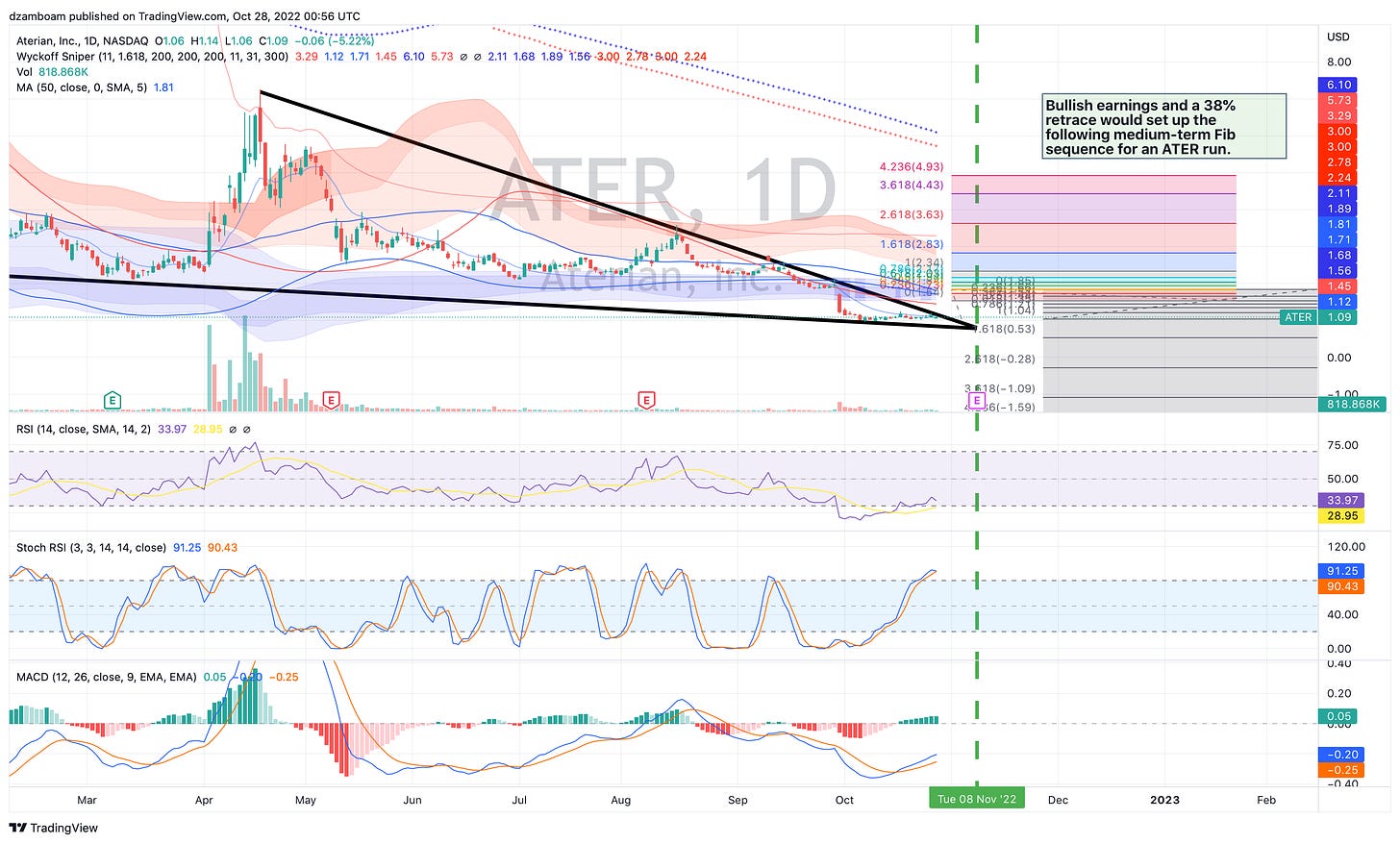

2. ATER’s Daily Chart.

Shown below is ATER’s daily chart:

This is one of the most textbook falling wedge patterns you will ever see in a stock chart. The top of this wedge was formed during the “Armistice Warrant Pump” in April, with the secondary peak forming in early August during the “Powell Pivot Pump”. The bottom of the wedge formed just before the April run-up, which at the time was associated with ATER’s then-52-week-low near $1.90. The dilution in late September caused a rapid dump from the $1.85 area down as low as $0.97.

After enduring this LONG and arduous stretch from April to November, this wedge CLEARLY terminates right at ATER’s earnings date on November 8. Midterm surprise anyone?

In my opinion, this is a bullish setup for an upside breakout sometime around ATER’s earnings report. My reasoning for this is as follows:

MACD has begun to curl upward, with daily RSI showing increasing strength.

Stochastic RSI is nearly topped out, indicating net buying (accumulation) since mid-October, which aligns with the end of the dilution.

The dilution (distribution) taking place in early October, followed by curling MACD and rising sRSI at sub $1.20 prices further indicates accumulation taking place.

Small caps (IWM) have shown better strength this past week against “mega tech” (i.e., Amazon, Meta, Tesla, etc.).

A general rule of thumb is that, when a reversal in a bear market is on the horizon, small caps almost always lead the market recovery. But not without a “flush” move (i.e., capitulation) where the market finds a new low while everyone panics. This sort of move is associated with a VIX move to 40+.

If capitulation happens, where does this put ATER?

2. What might a capitulation move look like?

See the following zoomed-in version of ATER’s chart below.

If ATER were to touch the bottom of this falling wedge, ATER’s price would fall somewhere around $0.80 (to within 2-3 cents) based on the trajectory of the bottom of the wedge. Why would ATER’s price fall this much? Well… 5 of the stock market’s biggest stocks (Tesla, Amazon, Meta, Google, and Microsoft) all reported weak guidance regardless of their earnings, with Meta and Amazon doing especially bad. Folks rushing to cash out of their mega-tech stock may force margin calls, and given most of the recent buying in ATER was bid-side, this (in my opinion) would be an algorithmically-triggered, low-volume selloff designed to get retail to panic sell. The HFT algorithms may be setting this up, given the inverted hammer candle that printed today (usually precedes a move down).

Remember what happened to SNAP around their earnings… dumping from $10+ to under $8? A move from $1+ to under $0.80 would be similar in magnitude. Though SNAP is likely to go down again in the event of a tech-driven selloff, it did recover from $7.33 back (briefly) to $10.04 in the coming days.

In Wyckoff Theory, they call this a “selling climax”. Based on my interpretation of the above two charts, I think ATER’s selling climax will come before earnings, if it hasn’t already happened with its most recent move to $0.97. Selling climaxes come before a move back up.

How far up do I think ATER can go, if it breaks out of this wedge? Based on the above charts, most of ATER’s daily accumulation bands (blue lines) have converged around $1.85. This level is significant as this was about the last trading price before Aterian diluted its float. A move from $1 or under to $1.85 would be at least an 85% move! For long term “HODLers” of ATER, this isn’t exactly exciting news, but for new holders of the stock, this represents an exciting entry point… or for the swing-traders, a chance to make a very solid return in a short amount of time (assuming the wedge breaks out to the upside).

3. What do I think ATER will do next?

ASSUMING the following two things happen:

ATER has a good earnings report, and

ATER breaks out of this wedge UP, not down.

I think ATER rapidly moves back up to it’s previous all time low near $1.85 (perhaps over a couple of days or so, but in this sort of move, most of the price move will happen very quickly).

ATER finding a new low would also confirm bullish RSI divergence. I’m not one to wish for a stock to go lower, but given just how clean this setup is, bullish RSI divergence would be one more critical data point supporting a future upside move.

Finally… as with all parabolic and rapid moves upward, retracements are healthy and needed. Most price moves retrace either 23.6% or 38.2% of their move… so, a move from $1.04 to $1.85 means ATER could retrace down to $1.54 and still maintain bullish momentum.

Beyond this… I will wait and see how this happens to make an attempt to figure out what ATER might do beyond that. But if ATER can clear $1.85+ and retrace no more than 38.2% of its move in this example… then another “leg up” would easily put ATER back in the $2 range. There are many other catalysts on the horizon, and we will need to see how the market reacts to next week’s Fed meeting (FOMC) and see where mega-tech finds support.

4. Parting Thoughts

Thanks all for reading! Remember to take care of yourself and your families before anything else.

Great DD DZ solid analysis !